Mid-Year Market Outlook

From interest rates and inflation to the job market and recession, we anticipate there will be a number of shifting elements in the economy for the remainder of the year and potentially into 2024. At the May meeting this year, the Fed increased its policy rate for the tenth consecutive time, pushing the upper bound of the fed funds rate to 5.25%, the highest since August 2007. The Fed’s aggressive rate-hiking campaign has been a focus for investors for over a year. Frankly, investors are probably ready to move on from the Fed being the centerpiece of most conversations.

We expect the Fed to change strategy during the latter half of 2023 for at least two reasons. First, the Fed should have less pressure to react to a tight labor market as the job market is set to cool throughout the remainder of the year. And second, the Fed will likely be less concerned inflation could get out of control from sticky- services inflation since we expect service prices to ease. One nagging inflation component that will ease in the coming months is rent, as a record number of new apartment units under construction will dampen rent prices. Expect investment opportunities in firms related to multi-family and mixed use projects.

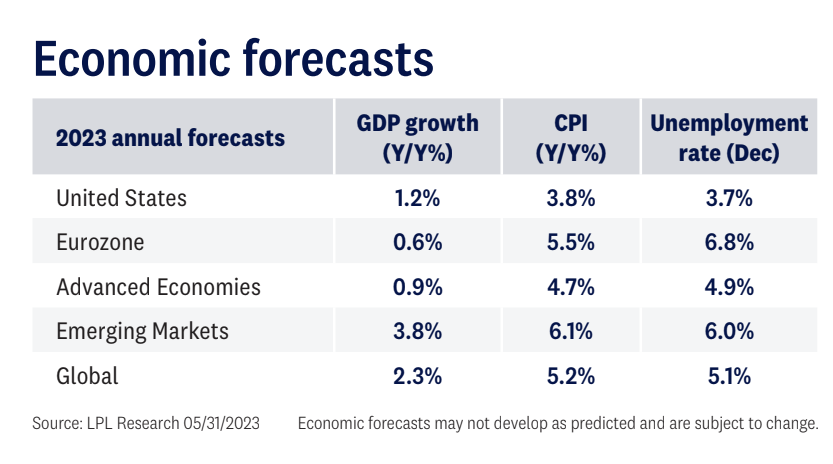

Investors will likely shift focus from central bankers to consumers. We expect less focus on tightening monetary policy and more on recession risk. The baseline forecast is the domestic economy slides into recession. However, solid growth in the first quarter and a potential recovery in the last few months of the year put annual U.S. growth close to a 1% forecast, outpacing the Eurozone. If job growth cools and the unemployment rate rises, consumers will likely experience declining disposable income, which could be the impetus for a recession as consumers pull back on spending. In the near term, consumers are still unleashing pent-up demand for services, especially within the leisure and hospitality sectors. But when the spending splurge ends, investors should expect some weakness in the consumer discretionary space.

Important Information Tracking # 1-05374736

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All data is provided as of July 5, 2023.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All index data from FactSet. The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This Research material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Past performance does not guarantee future results. Asset allocation does not ensure a profit or protect against a loss. For a list of descriptions of the indexes and economic terms referenced, please visit our website at lplresearch.com/definitions.