Navigating the Volatility of an Election Year

As we find ourselves in the midst of another election season, I wanted to take a moment to address some of the uncertainties and questions that may arise regarding investing during this time.

Elections often bring about heightened market volatility and increased speculation and it's natural to feel a sense of unease or hesitation about how political outcomes may impact our investments. However, I want to emphasize that maintaining a steady course during these times is crucial for long-term financial success.

It's so tempting to let our political beliefs, emotions, and all the noise around us influence our investment decisions. You might even catch yourself wondering if it's a good idea to cash out some gains and wait until the political dust settles. But here's the thing: our views on the economy often get colored by our political leanings. In fact, studies polling American’s views of the state of the U.S. economy shows that when a republican is in office, those who identify as republican tend to view the economy as doing a lot better than democrats do. The opposite is true for when a Democrat is in the White House.

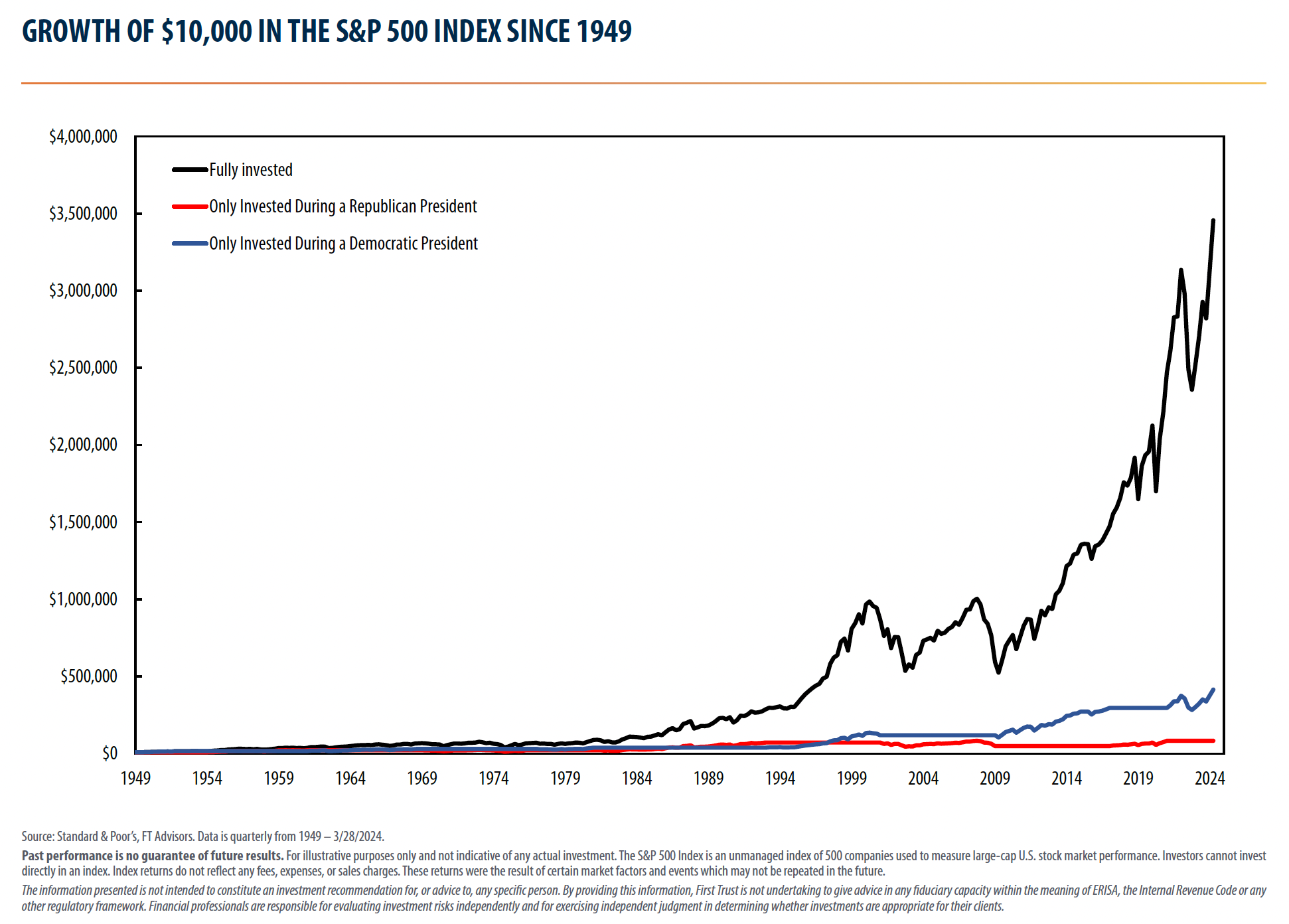

As you can see in the graph below, if we acted on that belief and sat in cash due to fear's about political outcomes, we would have left a lot of money on the table. Under both the Obama and Trump administrations, the S&P 500 returned an average of 16%, and 12% under Biden. Despite these large swings in economic perceptions, the economy grew at or around its 2% average growth rate through each administration.

So, staying invested during election seasons has really paid off, but history has also shown us that markets can be volatile leading up to an election, which is not something to be ignored.

Take a look at the graph below, showing the market performance during election years before and after election day.

In almost all presidential elections since 1980, markets moved higher after election day. The two notable exceptions were in 2000, when the tech bubble bursting continued to weigh on markets and the economy headed into recession in 2001, and in 2008, when the onset of the Financial Crisis weighed heavily 13on markets into 2009. Both macroeconomic events that had nothing to do with the election itself.

The markets don't like uncertainty so, after election day, when the source of uncertainty is cleared, regardless of the result, markets move on and focus on the fundamentals. In fact, in the first year of a presidential cycle, the market has averaged 9.88% and the market's have been positive 67 of the last 92 years.

Bottom line, people tend to invest based on their perceptions of the economic and investment environment. However, these perceptions can be heavily skewed by political preferences. No one can ever predict the markets so the best course of action is to have a long-term, diversified investment approach that can weather any storm that might come our way.

If you have any questions or concerns about investing during an election year, please don't hesitate to reach out to us. Our team is here to provide you with the support and guidance you need to navigate through this season with confidence!

The opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual.