Navigating the Post-Election Landscape

After last week’s whirlwind of national events and the election of Donald Trump as the 47th president, it's easy to feel as though much is out of our hands. However, there’s an empowering truth: The financial choices you make today—no matter the political landscape—are the ones that will most directly shape your future.

While it’s tempting to make investment decisions based on political outcomes or short-term market reactions, especially when the stakes feel high, the key to long-term financial success is maintaining a steady course.

Still, you might find yourself wondering if it's a good time to adjust your portfolio or even "sit on the sidelines" for a while to see how the political dust settles. But here's the important thing to remember: our views on the economy often get colored by our political leanings. In fact, studies polling American’s views of the state of the U.S. economy shows that when a republican is in office, those who identify as republican tend to view the economy as doing a lot better than democrats do. The opposite is true for when a Democrat is in the White House.

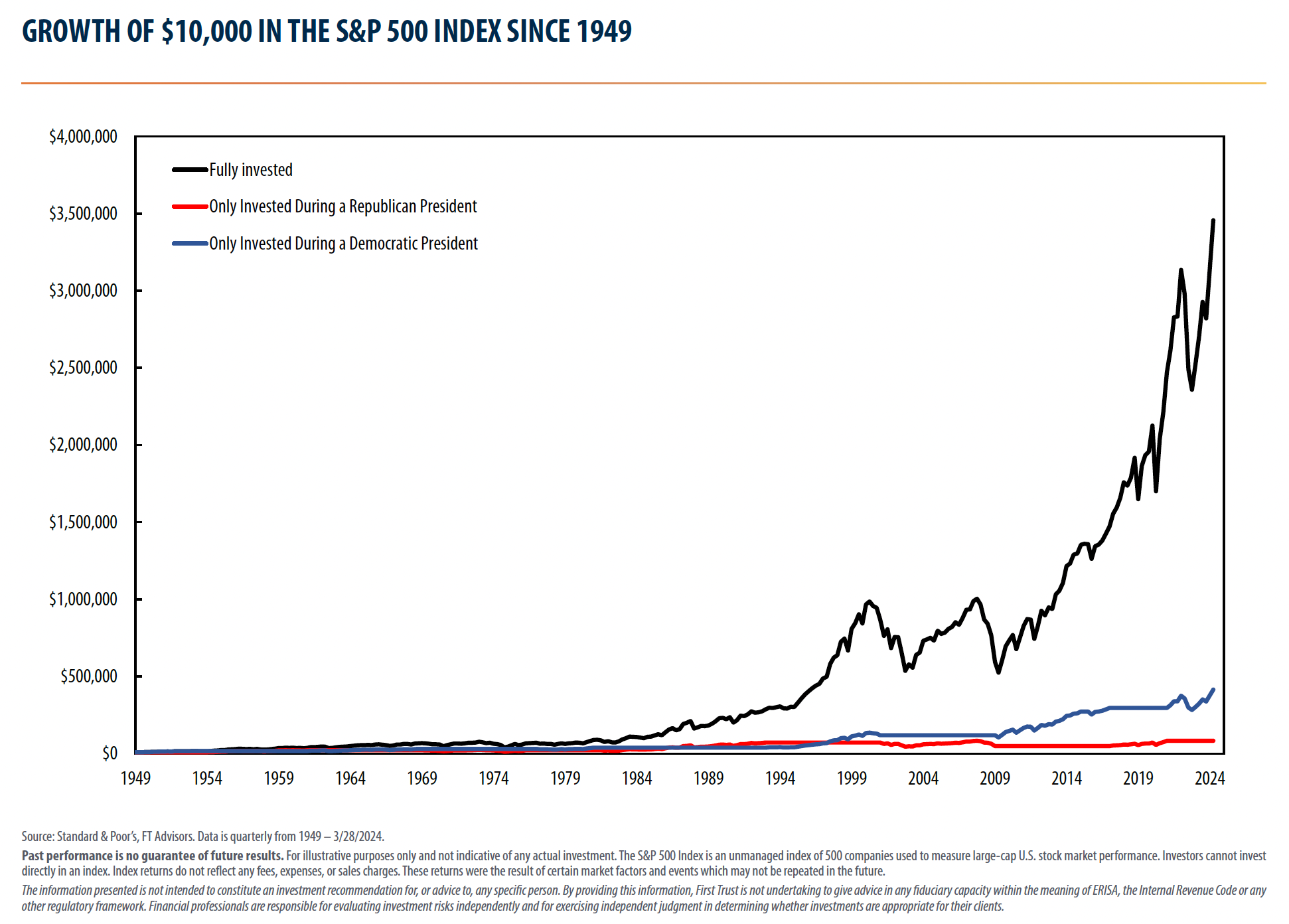

As you can see in the graph below, if we acted on that belief and sat in cash due to fear's about political outcomes, we would have left a lot of money on the table. Under both the Obama and Trump administrations, the S&P 500 returned an average of 16%, and 12% under Biden. Despite these large swings in economic perceptions, the economy grew at or around its 2% average growth rate through each administration.

As we look ahead, one thing is clear: the clarity provided by the election result itself can actually be a positive for investors. Historically, stock markets have responded well to the certainty that follows a major election, and with the economy on solid footing and profits growing, this outcome is no different.

In almost all presidential elections since 1980, markets moved higher after election day. The two notable exceptions were in 2000, when the tech bubble bursting continued to weigh on markets and the economy headed into recession in 2001, and in 2008, when the onset of the Financial Crisis weighed heavily 13on markets into 2009. Both macroeconomic events that had nothing to do with the election itself.

The markets don't like uncertainty so, after election day, when the source of uncertainty is cleared, regardless of the result, markets move on and focus on the fundamentals. In fact, in the first year of a presidential cycle, the market has averaged 9.88% and the market's have been positive 67 of the last 92 years.

Bottom line, while the political landscape may change, your financial goals remain the same. The most successful investors are those who stay disciplined and focused on their long-term objectives, rather than reacting to short-term market fluctuations or political noise. Timing the market based on political outcomes or economic predictions is a risky strategy that often leads to missed opportunities.

As we move forward, I encourage you to stay the course with your financial plan. The decisions you make today—based on your goals, time horizon, and risk tolerance—are what will truly set you up for future success. Remember, markets will continue to experience volatility, but staying invested and focused on your long-term strategy is the best way to weather any storm.

If you have any concerns or would like to discuss how the election might impact your portfolio, please don't hesitate to reach out to us. We’re here to help you stay informed and on track, no matter what’s happening in the political world.

The opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual.